|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50sua0kdz Unlock the future of client relationships with our definitive CRM Software Review, where we dive deep into the best CRM platforms on the market, spotlighting the game-changing Insurance Broker CRM that's revolutionizing the industry; say goodbye to clunky interfaces and hello to seamless, intuitive tools that empower insurance professionals to elevate customer interactions, streamline operations, and drive unprecedented growth, all while providing unparalleled insights that transform data into opportunity-experience the pinnacle of CRM innovation and propel your business to new heights with confidence.

https://www.bigin.com/templates/insurance.html

An insurance CRM software is designed to help insurance agents manage client relationships, smooth out sales processes, and ultimately, sell more policies. https://www.agent-crm.com/

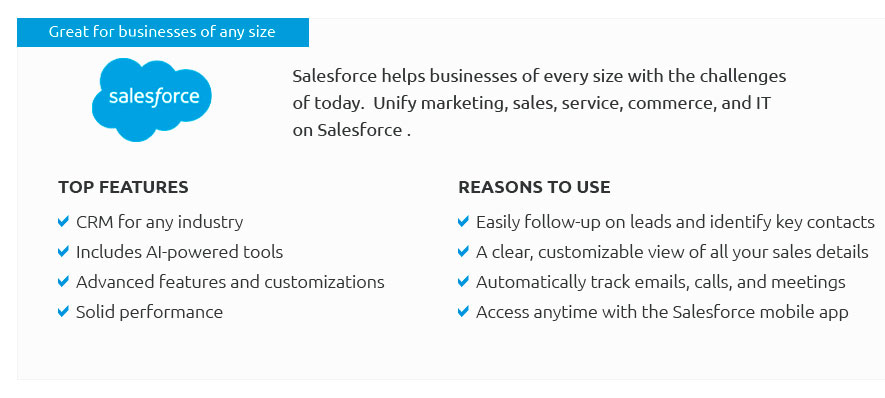

Agent CRM is the automation system that makes your life easier, helps convert more prospects to appointments and gives you the tools to upsell your current ... https://www.salesforce.com/financial-services/insurance-agency-management-software/

Salesforce has an open API architecture that integrates with other insurance agency management software. Salesforce is enabled with purpose-built solutions for ...

|